- 587-330-5529

- info@k2accounting.ca

Fractional Controller Services at K2 Accounting

Running a business means wearing many hats—but your financial leadership doesn’t have to be one of them. At K2 Accounting, our Fractional Controller services give you access to the expertise of a seasoned financial professional without the cost of a full-time hire. We step in to provide the financial oversight, strategic insight, and reporting your business needs to grow with confidence.

From managing budgets and cash flow to preparing financial statements and guiding long-term strategy, our fractional controller team ensures you always have a clear and accurate picture of your business performance. Whether you’re scaling, navigating challenges, or preparing for new opportunities, we help you make informed decisions backed by solid financial data.

With K2 Accounting, a fractional controller isn’t just about numbers—it’s about gaining a trusted partner who cares about your growth and success.

Financial Reporting

Good decisions come from good data. At K2 Accounting, our Fractional Controller Services ensure your financial reporting is accurate, timely, and meaningful. We don’t just produce reports—we translate numbers into insights that you can act on. From monthly and quarterly statements to custom dashboards and variance analysis, we give you a clear picture of your business performance. Whether you’re preparing for investors, lenders, or internal planning, our reports help you make confident, informed decisions.

Accounting System Optimization

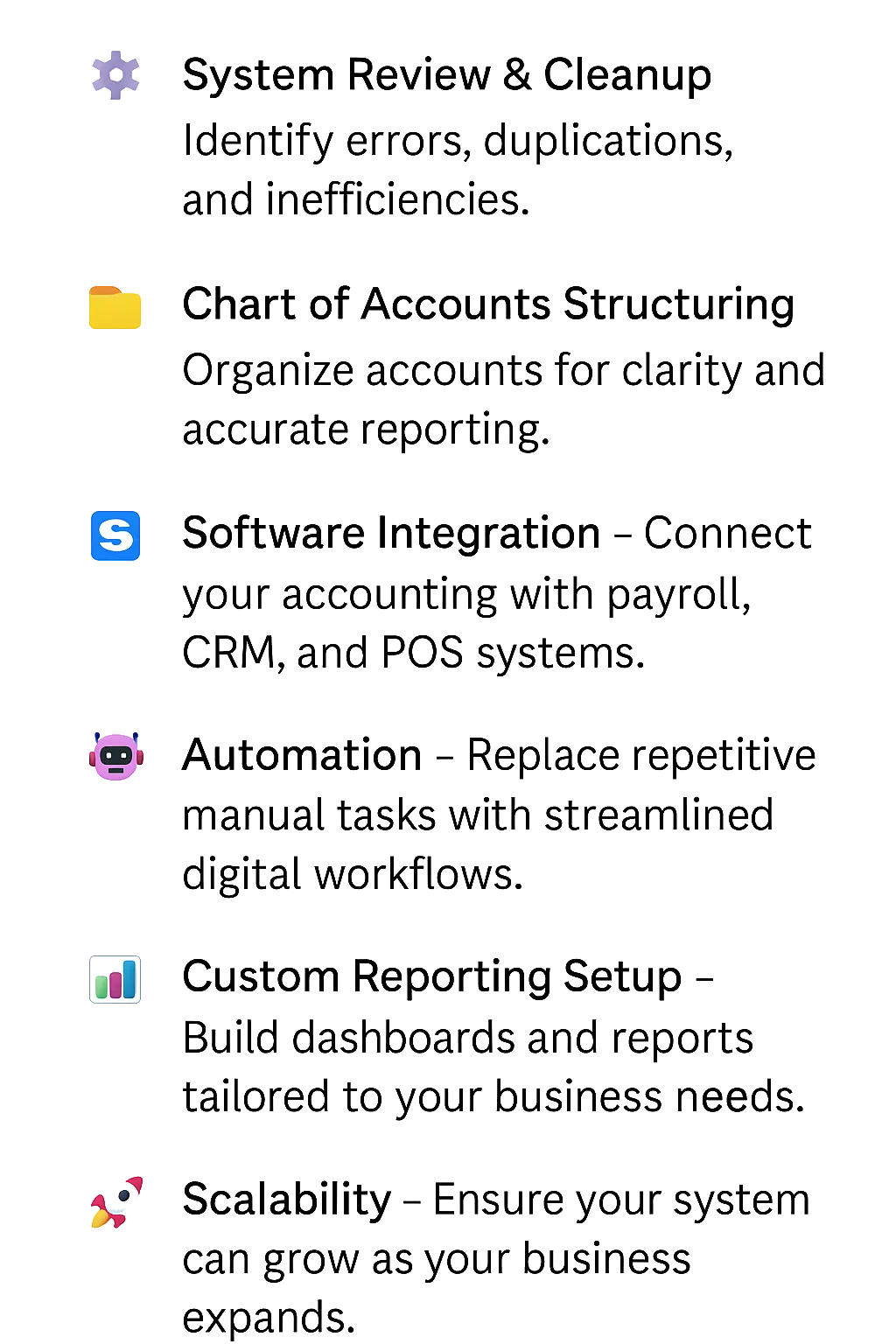

Your accounting system should do more than just record transactions — it should make running your business easier. At K2 Accounting, our fractional controller services help you optimize, streamline, and modernize your accounting systems so they work for you, not against you.

We review your current setup, identify where bottlenecks and errors are happening, and implement improvements that increase accuracy and efficiency. Whether that means restructuring your chart of accounts, integrating third-party tools, or automating manual processes, we make sure your system is built to support growth.

With an optimized accounting system, you can expect:

-

Clear, consistent financial data you can rely on

-

Faster, more efficient workflows with fewer manual tasks

-

Seamless integrations with the tools you already use

-

A system that grows with your business

Instead of fighting with outdated setups or spreadsheets, we’ll help you gain control with a streamlined accounting system that saves you time, reduces frustration, and gives you confidence in your numbers.

Process Improvement & Controls

Running a business without strong financial processes is like driving without a map—you might move forward, but you won’t always know if you’re on the right road. At K2 Accounting, our Fractional Controller services go beyond bookkeeping. We assess how your financial operations work today and design improvements that save time, reduce errors, and strengthen internal controls.

We help you build workflows that are efficient, reliable, and audit-ready. From setting up proper approval systems to standardizing reconciliations and automating manual tasks, we ensure your finances are both accurate and secure. Our goal is to give you peace of mind knowing your business is protected, your team is more productive, and your financial data is trustworthy.

What this means for you:

Workflow Assessment

We analyze your current financial processes to identify inefficiencies and risks, then design solutions that improve speed and accuracy.

Internal Controls Setup

From approvals to reconciliations, we implement safeguards that reduce errors, prevent fraud, and keep your business audit-ready.

Automation & Efficiency

Eliminate repetitive manual work with automated accounting workflows that save time and reduce costs. Focus on what matters

Risk Reduction & Compliance

We ensure your processes follow best practices, industry standards, and compliance requirements—giving you peace of mind.

Cash Flow Management

Cash flow is the lifeblood of your business. Even a profitable company can struggle if money isn’t flowing in and out at the right time. At K2 Accounting, our fractional controller services give you the oversight and strategies you need to stay on top of your cash flow—so you’re never caught off guard.

We don’t just look at the numbers today; we forecast your future needs, identify potential shortfalls, and build a plan to keep your business running smoothly. Whether it’s managing receivables and payables, aligning payment schedules, or preparing for seasonal fluctuations, we make sure you always know where you stand.

With our cash flow management services, you can expect:

Accurate Forecasting

Predict future cash needs and plan with confidence.

Receivables & Payables Oversight

Stay on top of invoices, collections, and outgoing payments.

Timing Optimization

Align expenses with income to prevent shortfalls.

Risk Management

Identify red flags early and take proactive steps.

Improved Liquidity

Ensure your business has the cash on hand to operate and grow.

Strategic Planning Support

Use cash flow insights to guide smarter business decisions and fuel long-term growth.

Expert Financial Oversight Without the Full-Time Cost

Managing a growing business means more than just keeping the books balanced—it requires financial oversight, smarter processes, and clear insights. At K2 Accounting, our fractional controller services give you controller-level expertise without the full-time cost. From financial reporting and system optimization to cash flow management and internal controls, we help you gain the clarity and confidence you need to make stronger business decisions.

What is a fractional controller?

A fractional controller is an experienced financial professional who oversees your accounting and financial operations on a part-time or as-needed basis. You get controller-level expertise without the cost of hiring a full-time employee.

How is a fractional controller different from a bookkeeper or accountant?

Bookkeepers record transactions and keep your books up to date, while accountants prepare financial statements and tax filings. A fractional controller goes a step further—analyzing data, improving processes, managing cash flow, and ensuring accurate financial reporting.

What size of business benefits most from a fractional controller?

Small to mid-sized businesses that have outgrown basic bookkeeping but don’t need (or can’t justify) a full-time controller often find the most value. It’s the perfect fit for growing companies that want better financial oversight.

Can a fractional controller help with cash flow management?

Yes. One of the main roles of a fractional controller is to monitor cash flow, forecast future needs, and make sure your business always has enough liquidity to operate and grow.

Will a fractional controller work with my existing accounting system?

Absolutely. We optimize your current accounting systems, integrate them with other tools you use, and ensure everything runs efficiently—whether you’re on QuickBooks, Xero, or another platform.

How flexible are fractional controller services?

Very flexible. You can scale up or down depending on your needs. Whether you need help monthly, quarterly, or during peak growth, our services adapt to your business.