- 587-330-5529

- info@k2accounting.ca

Bookkeeping Services at K2 Accounting

Managing a business is challenging enough without having to worry about whether your books are accurate. At K2 Accounting, we provide professional bookkeeping services that keep your finances organized, up to date, and ready whenever you need them.

From transaction recording and payroll to monthly reporting and tax-ready financials, our bookkeeping team ensures you always have a clear picture of where your business stands. We make bookkeeping simple, so you can focus on running your business with confidence.

With K2 Accounting, you’re not just getting bookkeeping — you’re gaining a partner who cares about your success.

Transaction Recording & Data Entry

Accurate bookkeeping starts with getting every transaction recorded properly. At K2 Accounting, we handle the day-to-day data entry that keeps your books reliable and up to date. Whether it’s sales, expenses, invoices, or payments, our bookkeeping services ensure nothing gets missed.

By keeping a close eye on every transaction, we give you a clear and organized financial picture of your business. No more late nights sorting receipts or worrying about missing entries — we take care of the details so you always know exactly where your money is going.

With professional transaction recording and data entry, you can count on consistent, accurate bookkeeping that helps you make better business decisions with confidence.

Accurate Daily Entries

Every sale, expense, and transaction is recorded with precision, ensuring your books reflect the true state of your business.

Bank & Card Reconciliations

We match your bank and credit card statements with your records, so errors, duplicates, or missed entries never slip through.

Digital Receipts & Invoices

From receipts to invoices, we organize and digitize your documents, making it easy to track and retrieve records anytime.

Real-Time Tracking

Stay on top of your finances with up-to-date transaction records, giving you clear insights into your cash flow at any time.

End-to-End Payroll Solutions

Managing payroll can be one of the most time-consuming and sensitive parts of running a business. At K2 Accounting, we handle your payroll from start to finish—accurately, securely, and on time—so you can focus on your team and your growth.

Here’s what our payroll services include:

Employee Setup & Records

We manage employee onboarding, tax forms, and record-keeping to ensure compliance from day one.

Accurate Payroll Processing

From hourly staff to salaried employees, we calculate wages, deductions, and benefits correctly—every time.

Direct Deposits & Pay Stubs

Seamless, secure deposits to employee accounts with detailed pay stubs accessible online.

Tax Withholdings & Compliance

We handle CRA deductions, remittances, and year-end T4 slips so your business stays compliant.

Custom Payroll Schedules

Weekly, bi-weekly, or monthly—your payroll runs smoothly based on your company’s needs.

Integrated with Bookkeeping

Your payroll data flows directly into your books, making reporting and financial management simple.

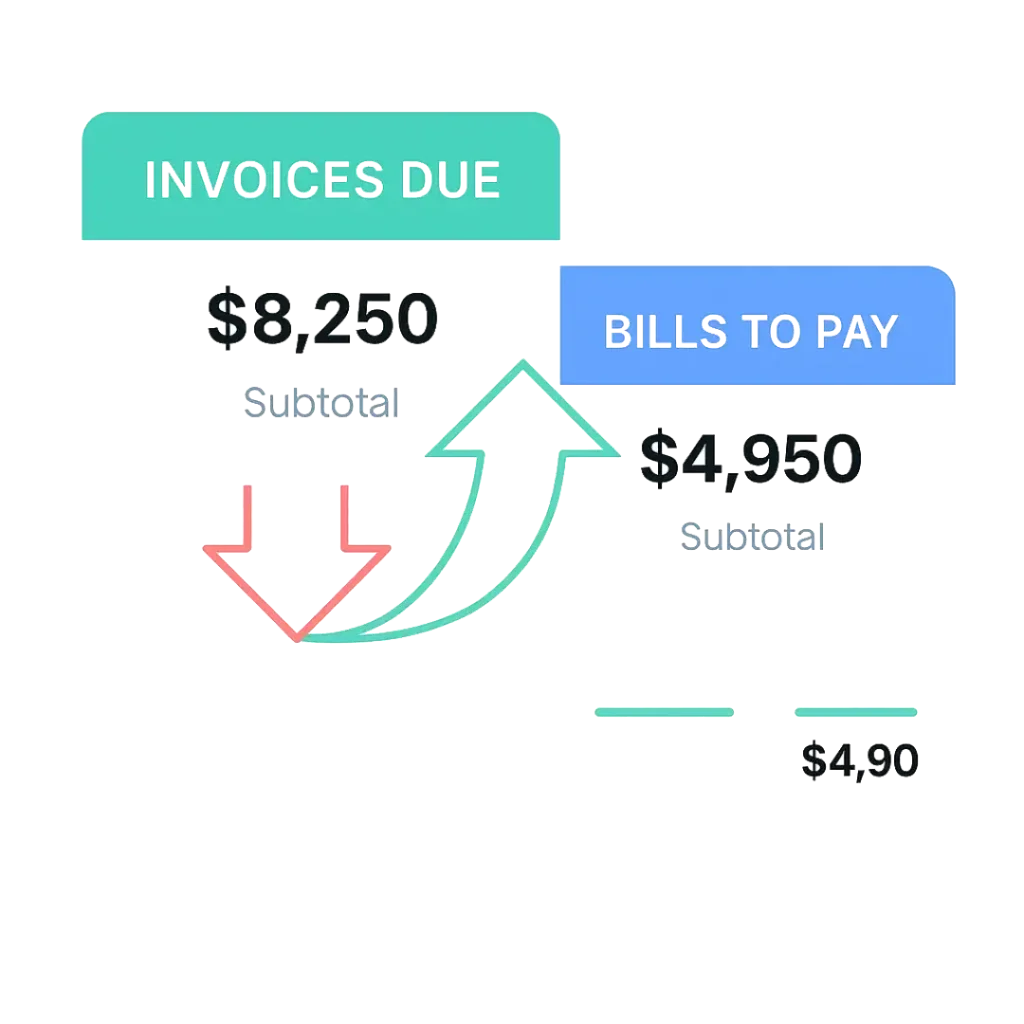

Accounts Receivable & Payable Management

Staying on top of cash flow is one of the biggest challenges for any business. At K2 Accounting, our bookkeeping services ensure your accounts receivable and accounts payable are managed with accuracy and efficiency, so you always know what’s coming in and what’s going out.

Accounts Receivable

-

Track and record all customer invoices.

-

Monitor overdue accounts and send reminders.

-

Maintain accurate records for clear cash-in visibility.

-

Improve collection times to keep your business moving.

Accounts Receivable

-

Record and schedule all vendor bills and payments.

-

Manage due dates to avoid late fees and missed deadlines.

-

Ensure compliance with supplier terms and tax requirements.

-

Provide real-time reporting for better budgeting and planning.

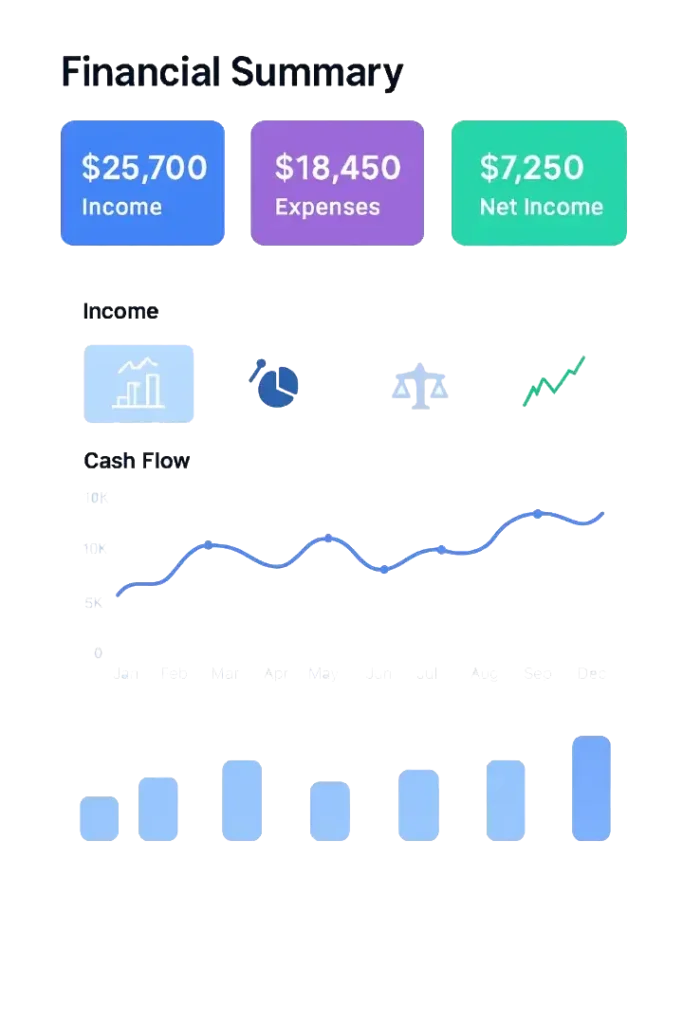

Monthly Reporting Made Simple

Numbers don’t have to be confusing. At K2 Accounting, our monthly reporting services transform raw financial data into clear, easy-to-read reports that give you a full picture of your business health. Instead of just tracking numbers, we break them down into insights you can actually use to make smarter decisions. From profit and loss statements to detailed cash flow reports and tailored custom reporting, you’ll always know exactly where your business stands, how it’s performing, and where improvements can be made. With reliable monthly reporting, you gain the clarity and confidence to plan ahead and focus on growth.

We provide detailed profit and loss statements that go beyond the numbers, showing you exactly how your business is performing each month. This helps you see where revenue is growing, where costs are rising, and how your bottom line is really doing.

Our cash flow reports track every dollar coming in and going out, so you’re never left wondering about your liquidity. By staying on top of cash movement, you can avoid surprises, plan for expenses, and keep your business financially healthy.

Every business is unique, which is why we create tailored reports designed for your specific industry and goals. Whether you want to focus on budgeting, forecasting, or growth metrics, our custom reports deliver the insights you need to make confident business decisions.

Tax-Ready Financials

Tax-Ready Financials Without the Stress

Tax season doesn’t have to be overwhelming. At K2 Accounting, we make sure your books are always accurate, up to date, and fully compliant so you’re never scrambling to get things in order. Our tax-ready financial services ensure that when it’s time to file, you already have everything you need — organized, reconciled, and ready to go.

With clean, audit-proof records and accurate financial statements, you can minimize errors, reduce the risk of penalties, and save valuable time. Whether it’s preparing year-end reports, managing sales tax, or staying compliant with CRA requirements, we handle the details so you can focus on running your business with peace of mind.

Accurate Year-End Reports

We prepare precise year-end financial statements, ensuring your records are complete, consistent, and ready to file. No more last-minute rush or missing documents.

Tax Compliance Made Simple

Our team ensures your books align with CRA guidelines, helping you avoid costly penalties and giving you confidence when it’s time to file taxes.

Sales Tax Filings

From GST/HST to PST, we manage your sales tax calculations and filings so you’re always compliant and never overpay.

Audit-Ready Documentation

We maintain detailed, organized records that stand up to scrutiny. If you ever face an audit, you’ll have peace of mind knowing everything is prepared and accurate.